Limited Liability Partnership

LLP is an alternative corporate business form that gives the benefits of limited liability of a company and the flexibility of a partnership. The LLP can continue its existence irrespective of changes in partners. It is capable of entering into contracts and holding property in its own name. The LLP is a separate legal entity, is liable to the full extent of its assets but liability of the partners is limited to their agreed contribution in the LLP. Further, no partner is liable on account of the independent or un-authorized actions of other partners, thus individual partners are shielded from joint liability created by another partner’s wrongful business decisions or misconduct. Mutual rights and duties of the partners within a LLP are governed by an agreement between the partners or between the partners and the LLP as the case may be. The LLP, however, is not relieved of the liability for its other obligations as a separate entity.Since LLP contains elements of both ‘a corporate structure’ as well as ‘a partnership firm structure’ LLP is called a hybrid between a company and a partnership.

Minimum number of partners to incorporate an LLP is 2. There is no upper limit on the maximum number of partners of LLP. Among the partners, there should be minimum two designated partners who shall be individuals, and at least one of them should be resident in India. They are directly responsible for the compliance of all the provisions of LLP Act 2008 and provisions specified in LLP agreement.

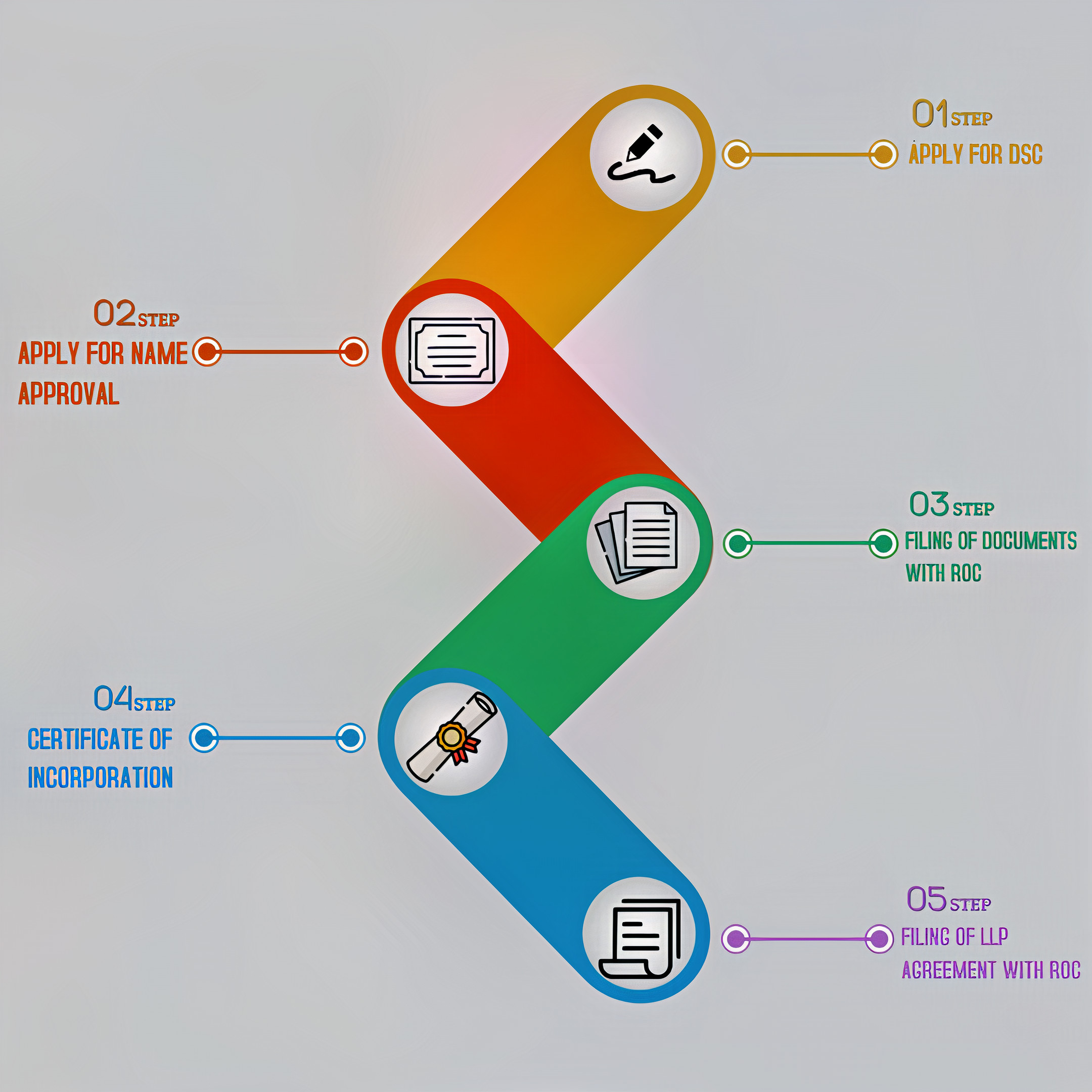

If you want to start your business with Limited Liability Partnership, then you must get it registered under Limited liability Partnership Act, 2008.

Features of Limited Liability Partnership

i. It has a separate legal entity just like companies

ii. The liability of each partner is limited to the contribution made by partner

iii. The cost of forming an LLP is low

iv. No requirement of minimum capital contribution

v. Operates on the basis of an agreement.

vi. Flexibility without imposing detailed legal and procedural requirement.