Conversion Of LLP To Private Limited Company

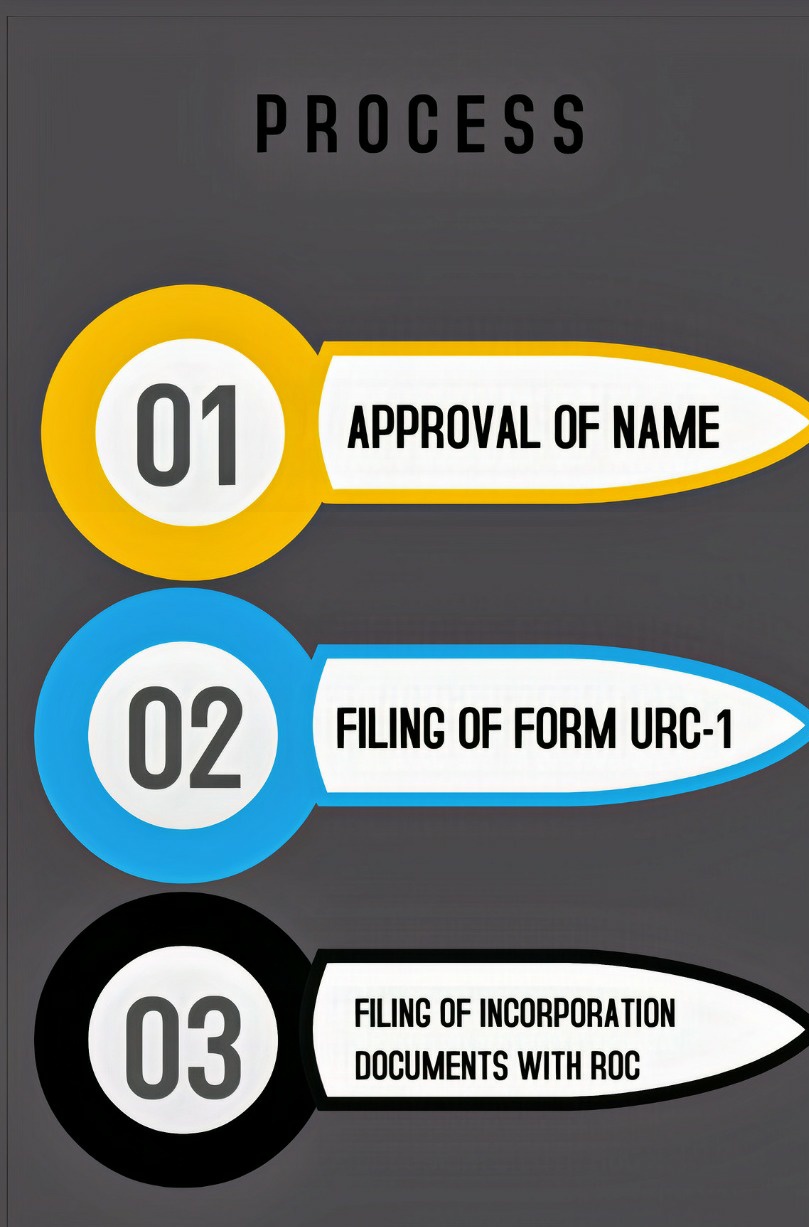

Ministry of Corporate Affairs has passed a notification on 31st May, 2016 in such notification its allowed conversion of LLP into Company. For such conversion there is need to prepare a list of documents and required to file the same with ROC in forms like URC-1, Spice plus etc. While conversion there is need to consider the implications of income Tax provisions also like Capital Gain.