GOODS AND SERVICE TAX (GST)

GST Registration of a business with the tax authorities implies obtaining a unique, 15-digit Goods and Service Tax Identification Number (GSTIN) from the GST authorities so that all the operations of and the data relating to the business can be collected and correlated. In any tax system this is the most fundamental requirement for identification of the business for tax purposes or for having any compliance verification program.

In the GST Regime, businesses whose turnover exceeds Rs. 40 lakhs (Rs 10 lakhs for North East and Hill states) is required to register as a normal taxable person. This process of registration is called GST registration.

ADVANTAGES OF GST REGISTRATION

1. Legally recognised as supplier of goods or services.

2. Proper accounting of taxes paid on the input goods or services which can be utilised for payment of GST due on supply of goods and/or services by the business.

3. Pass on the credit of the taxes paid on the goods and/or services supplied to purchasers or recipients.

4. Authorization to a taxpayer to collect tax on behalf of the Government

GST REGISTRATION IS MANDATORY FOR THE FOLLOWING

i. You make Inter-State Supplies

ii. You supply goods through an E-commerce portal

iii. You are a/an - Service Provider, Agent for Registered Principal, Liable to Pay Reverse Charge, Non-resident Taxable Person, Casual Taxable Person, Input Service Distributor, TDS/TCS Deductor, E-commerce Operator, An online data access and retrieval service provider

TIME LIMIT FOR GST REGISTRATION

Within 30 days from the date when your liability arose. In case of a Casual Taxpayer or Non-resident taxable person, 5 days prior to the commencement of the business.

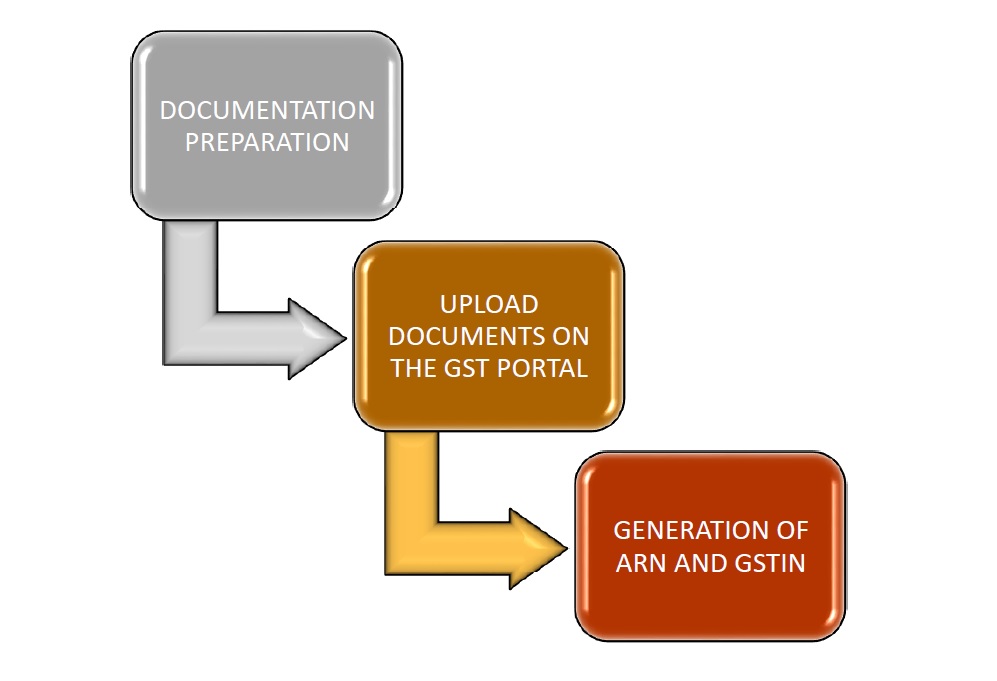

PROCESS FOR GST REGISTRATION

DOCUMENTS REQUIRED FOR GST

1. PAN card

2. Adhaar card

3. Passport size photograph

4. Valid and accessible e-mail ID and Mobile Number

5. Bank Statement/Cancelled Cheque/First page of Passbook

6. Premises proof such as Electricity bill, receipt issued by municipality board, property tax receipt.

7. In case of rented property Rent Agreement and NOC from the owner

8. In case of LLP-Certificate of Incorporation of LLP.

9. Certificate of Incorporation of Company

10. Memorandum of Association(MOA) and Article of Association(AOA) of Company

11. Letter of authorization for authorized signatory of LLP/Company including photograph

12. Details of additional places of business, if applicable

13. Valid Class II or Class III DSC of authorised signatory in case of companies and LLPs

14. Valid Class II or Class III DSC or Aadhaar (for E-Sign option) in case of other entities

Note: Your mobile number should be updated with the Aadhaar authorities otherwise you cannot use E-Sign option because OTP will be sent to the number in the Aadhaar